does binance send tax forms

Log in Get Started We dont accept any new clients for 2021 tax season see you next year. BinanceUS is making it easier for users to complete their tax returns by upgrading our tax reporting tool.

3 Lessons Web 3 0 Can T Afford To Ignore Sponsored Bitcoin News Bestcryptotrends Com In 2022 Technological Change Blue Artwork Private Server

Import trades automatically and download all tax forms documents for Binance easily.

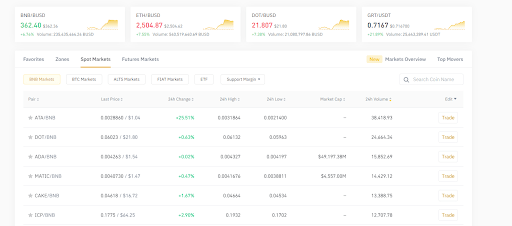

. BinanceUS is a fast and efficient marketplace providing access and trading for 85 digital assets. Binance is not a US-based exchange and it does not report anything to the IRS. Does binance report to tax.

If your account meets both of the above criteria BinanceUS will send you a Form 1099-K in January 2021 to your accounts address of record. Filing cryptocurrency taxes can be complicated especially for those who are new to crypto. We have integrated binance via api on beartax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes.

Taxpayers to answer yes or no to whether they had any crypto transactions during the year. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. There are a few ways you can import your transactions to Coinpanda.

Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards compliance and could avoid. Please consult an outside tax. BinanceUS makes answering this requirement easier by providing you with your transaction history available to download.

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Based exchanges such as Coinbase and Gemini will fill out IRS forms for you Binance only gives a list of all your trade history. If you receive a Form 1099-K or Form 1099-B from a crypto exchange without any doubt the IRS knows that you have reportable cryptocurrency transactions.

They can request your data from any larger crypto exchange operating in the US. In this article well show you how you can prepare for the tax season and export your transaction history. The best way to remain tax compliant with the IRS is to report your crypto taxes accurately.

It is a one stop shop for cryptocurrency trading buying and. Individual Income Tax Return requiring US. Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards.

While Binance US might not be sending out 1099-K forms the IRS is taking a hard stance on crypto tax evasion. BinanceUS does NOT provide investment legal or tax advice in any manner or form. We will continue evaluating coins tokens and trading pairs to offer on BinanceUS in accordance with our Digital Asset Risk Assessment Framework community feedback and market demand.

This is thanks to the matching mechanism embedded in the IRS Information Reporting Program IRP. Although it previously issued certain traders Forms 1099-K BinanceUS discontinued the practice. Answer 1 of 12.

Missing transactions must be imported manually since Binance does not allow exporting the completely history as XLSXCSV. Binance does not do much of the hard work for you when it comes to calculating your crypto taxes. Binance does not issue a 1099 form to its customers because it is not a US-based exchange and it no longer serves US.

If you need to file taxes for your cryptocurrency investments you can generate a statement of your Binance account to perform tax calculations. Binance does not do much of the hard work for you when it comes to calculating your. Binance does not allow exporting your conversions so this must be added manually.

December 10 2021 - 2 min read. These kinds of incomes are classified as ordinary income. 1099 form on your own or send them to your tax account assistant.

Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada. Here is how it works. According to their website they stopped issuing 1099-K s from 2021 so they dont report to the IRS.

Binance does not do much of the hard work for you when it comes to calculating your crypto. Please utilize your transaction history to fulfil any local tax filing. During any tax year if you have more than 20000 proceeds and.

Does Binance report to tax authorities. NO Binance does not report to the IRS. Prepare your tax forms for Binance US.

Please consult an outside tax professional for guidance on your personal tax obligations. Binance is the largest cryptocurrency exchange founded in 2017 by Changpeng Zhao. If you expected to receive a Form 1099-K but didnt you probably only met one of the qualifications listed above not both.

Connect your account directly using API keys. These transactions will be imported as Receive and you will need to change the transaction type to Send after uploading the file. Does binance provide tax forms.

The ownership of any investment decisions exclusively vests with you after analyzing all possible risk factors and by exercising your own independent discretion. BinanceUS shall not be liable for any consequences thereof. If you earned at least 600 through staking or Learn and Earn rewards BinanceUS issues 1099-MISC s and reports to the IRS.

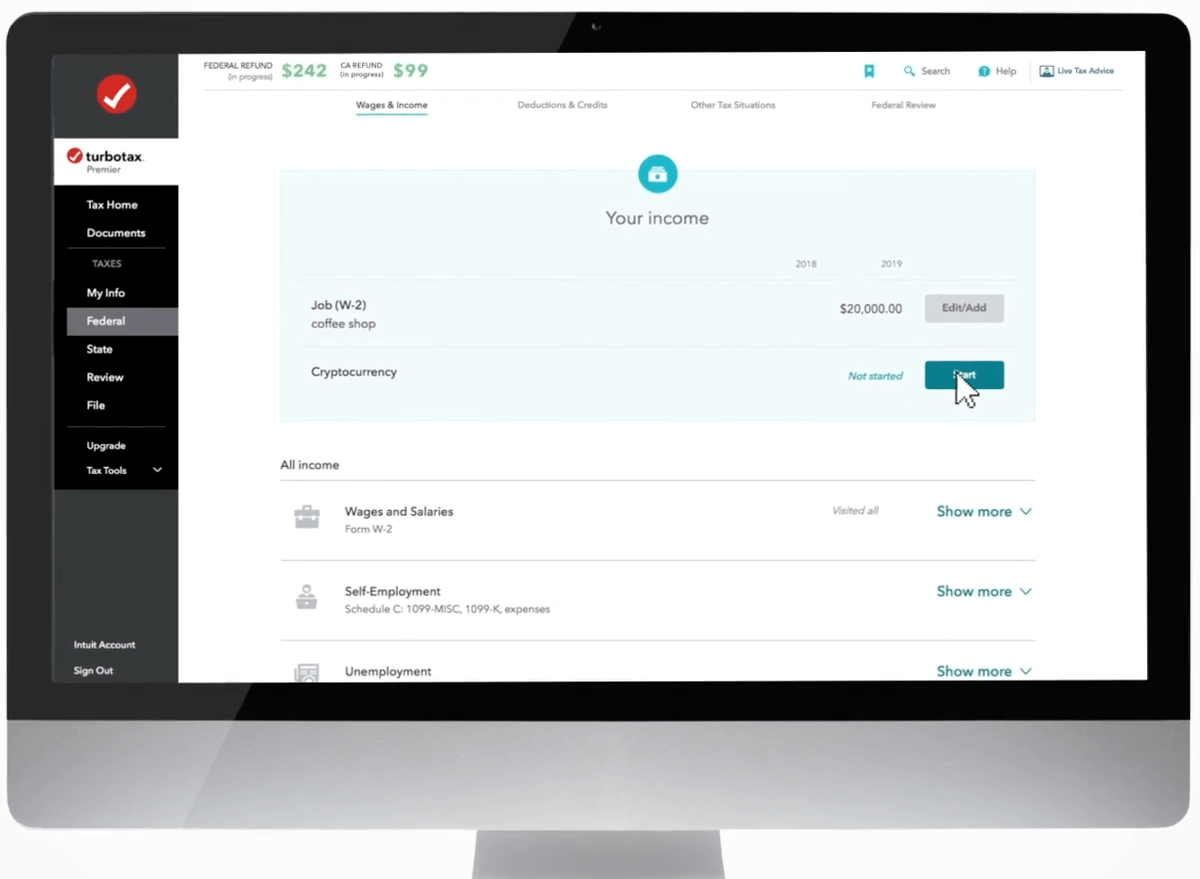

In 2019 the IRS introduced a mandatory check box on Form 1040 US. Import your Binance US trades automatically generate your tax forms and file your taxes. This is the simplest way to synchronize all your trades and transactions automatically.

Log in to your Binance account and click Wallet - Transaction History. Which Tax Documents Does Binance Give You. It performs over 1400000 transactions per second.

Please visit this page to learn more about it. Answer 1 of 5. They have their headquarters in Malta.

Binance a Malta-based company is one of the most popular crypto exchanges in the world. Simply follow the steps below to get your API keys key secret and your tax forms will be. Yes Binance does provide tax info but you need to understand what this entails.

The IRS will receive a duplicate copy of your Form 1099-K. Binance gives you the option to export up to three months of trade.

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Right Here S Why Bears Hope To Pin Bitcoin Below 60k Forward Of Friday S 1 1b Choices Expir

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

3 Steps To Calculate Binance Taxes 2022 Updated

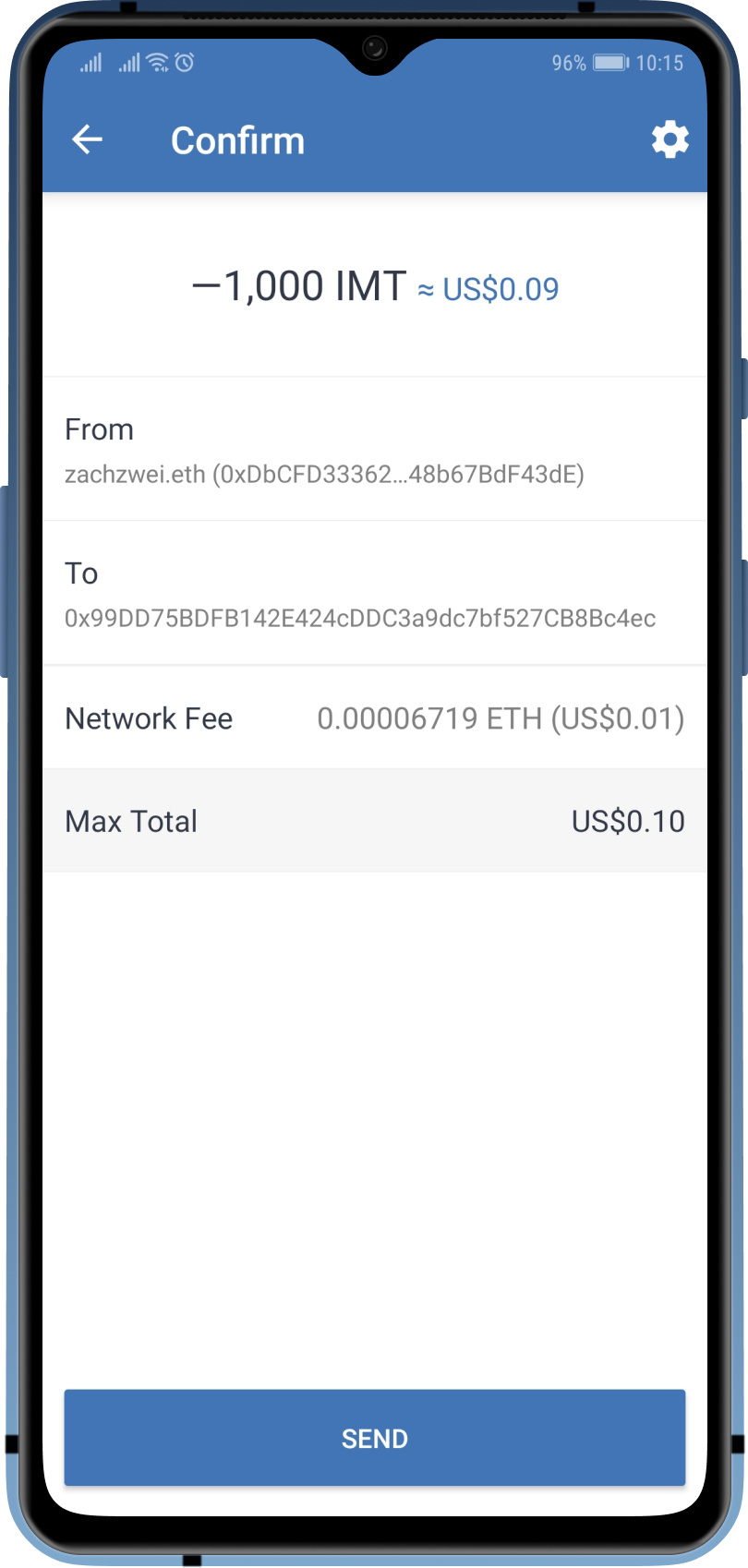

Sending Cryptocurrencies Faqs Trust Wallet

100 Legit Track Mtcn Before Payment Contcat Us For Your Own Mtcn Today Get Western Western Union Money Transfer Western Union Money Market Account

3 Steps To Calculate Binance Taxes 2022 Updated

3 Steps To Calculate Binance Taxes 2022 Updated

3 Steps To Calculate Binance Taxes 2022 Updated

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Report Your Binance Taxes Binance Tax Forms

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

3 Steps To Calculate Binance Taxes 2022 Updated

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek